Eddie Jordan, the former F1 mogul, is waging a legal war against HSBC. Why? Because a ‘low risk’ £47 million loan became a financial quagmire for Jordan’s Pendragon Investment Holdings. Despite assurances for minimal risk, the investment led to a staggering 10% loss, prompting a lawsuit.

In the world of high finance and big motorsports, this lawsuit has grabbed headlines. Jordan’s claim revolves around what he sees as a failure by HSBC to properly evaluate risk, leaving his investment significantly drained. How did a ‘stressed scenario’ result in such a financial setback? Let’s dig into the details.

The Genesis of a Legal Battle

Eddie Jordan’s journey with HSBC began on a promising note back in 2009. As a client of HSBC Private Bank, he was no stranger to the world of high-stakes investments. However, his recent decision to invest £47 million in HSBC GIF’s low-risk bond fund from 2019 to 2023 has soured that relationship.

Over the years, clients like Jordan have often been tempted by the allure of low-risk, high-return investment schemes. But despite the label, risks lurked beneath the surface. HSBC, a banking behemoth, stands accused of understating these risks, pushing Jordan into a financial abyss.

From Assurance to Disillusionment

HSBC’s promises were golden, or so it seemed. The bank suggested that only a worst-case scenario would see losses of up to 0.98%. But reality crushed these assurances when the bonds plummeted by 10%.

For financial giants, maintaining client trust hinges on their forecasts holding true. In this case, Jordan feels deceived, as his net worth took a substantial hit. HSBC’s previous reassurances now sound anything but comforting.

Jordan’s Quest for Compensation

Desiring recompense, Jordan demands £4.94 million, accounting for the disparity between his investment and the current bond value.

HSBC, on the other hand, raked in a tidy profit from interest and fees, totaling over £4 million. Jordan sees this as a betrayal, claiming damages to his once-sturdy investment portfolio.

The legal claim lays bare the perceived breach of trust, pivotal in financial advisory relationships. Jordan alleges a significant oversight in risk management, questioning HSBC’s diligence.

A Veteran Speaks Out

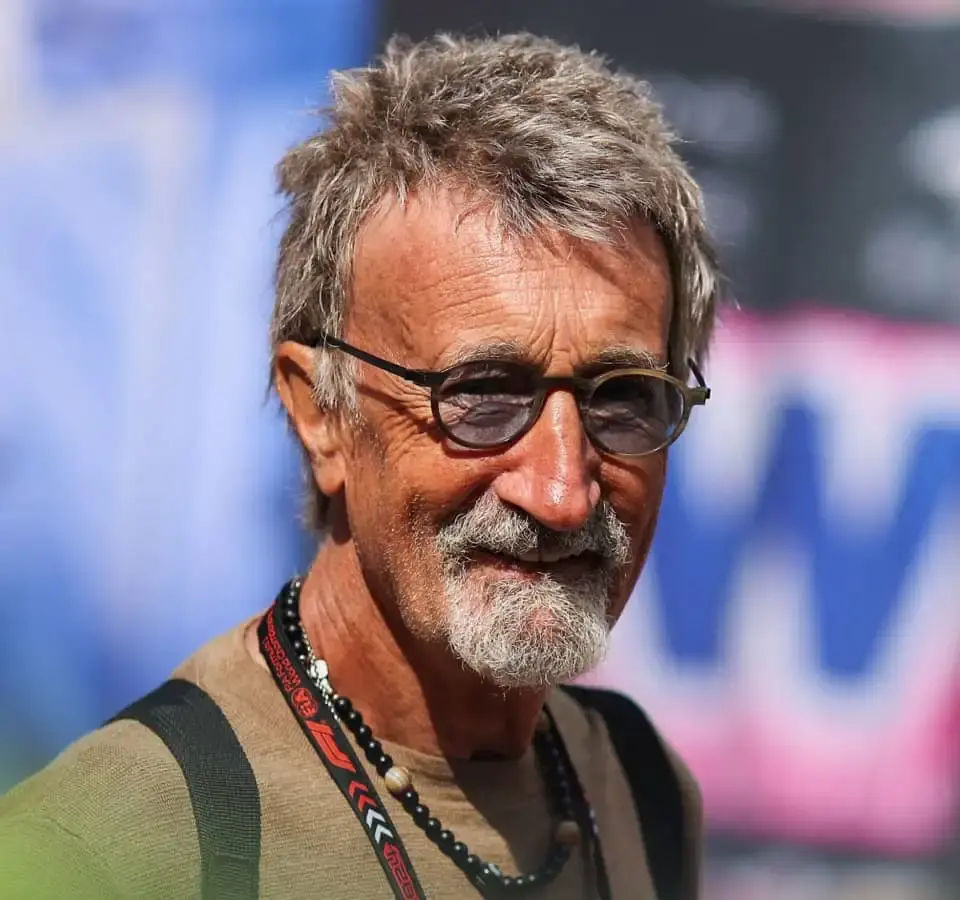

Eddie Jordan isn’t simply an aggrieved investor; he is a figure with a storied legacy in motorsports.

His insights aren’t confined to finance. As he recently critiqued Audi’s F1 strategies, it’s clear he views global brands through a multifaceted lens. It’s no wonder his clash with HSBC resonates beyond standard client complaints.

The legal tussle has thrust Jordan back into headlines, highlighting his powerful voice in both industries.

HSBC’s Side of the Story

Though quiet on specifics, HSBC maintains its stance of responsible financial management. According to them, Jordan’s interpretation of events is misguided or diluted.

Their operation’s defense rests on prior informed decisions and risk disclosures to clients. However, investors like Jordan rarely overlook adverse financial outcomes when they occur unexpectedly.

HSBC will likely bolster its argument with extensive policy documents, showcasing transparency in their client interactions.

Formula 1 and Financial Scrutiny

Jordan’s case against HSBC is not just a banking story; it touches on the wider trust between public figures and financial institutions. With a hefty net worth from his F1 prowess, Jordan’s legal stance invites scrutiny from both sectors.

His claim could influence other high-value investors to revisit their banking alliances. Edifice of trust built over years can crumble within minutes of contract mishaps.

Financial entities worldwide are thus watching this high-profile case closely, wary of its implications on future client allegiances.

Looking Ahead in Motorsport and Finance

Eddie Jordan’s name is often linked with groundbreaking F1 moments. His hard-hitting perspective fuels conversations about the future of both finance and racing.

Despite the current predicament, Jordan remains a pivotal figure in both circles, advocating for transparency and accountability.

The lawsuit sheds light on the complexities of financial dealings, especially for those balancing multiple high-risk ventures simultaneously.

Repercussions for the Financial Sector

If victorious, such claims might urge financial bodies to redefine risk frameworks and client counseling methodologies.

HSBC’s path will be examined through this legal lens, determining if their standards uphold scrutiny. Clients and banks alike are poised on the edges of change, observing potential industry shifts.

For now, the legal proceedings remain under the spotlight, with wider industry practices hanging in balance.

A Cautionary Tale

The case serves as a reminder: even seasoned investors face unforeseen setbacks. But it’s not about how one falls; it’s about how one rises.

Financial news is rife with such tales, but they rarely see figures like Jordan on center stage. His relentless pursuit for justice underscores not only personal loss but broader financial accountability.

The Road to Resolution

Ultimately, this legal battle is about more than numbers. It’s about restoring faith in financial systems we rely on.

Eddie Jordan’s journey is far from over. As he navigates the intricacies of both the legal world and financial landscapes, his resolve will perhaps inspire necessary introspection within banking practices.

This clash between Jordan and HSBC may drive reevaluations in client relations across finance. As the case unfolds, many await its impact.

In the world of finance and racing, Eddie Jordan’s bold stand speaks to a broader call for transparency and accountability, propelling key industry discussions.